|

Nevertheless, a state should guarantee it provides a smooth, streamlined registration procedure for families. Going beyond the abilities of timeshare foreclosure process the FFM in this location is a must-do for any state thinking about an SBM. Low-income individuals experience earnings volatility that can affect their eligibility for health protection and cause them to "churn" frequently between programs. States can use the higher versatility and authority that features running an SBM to protect citizens from protection gaps and losses. At a minimum, in preparing for an SBM, a state not incorporating with Medicaid needs to work with the state Medicaid company to develop close coordination in between programs. If a state instead continues to transfer cases to the Medicaid agency for a determination, it needs to prevent making individuals provide extra, unnecessary information. For instance it can guarantee that electronic files the SBM transfers include details such as eligibility aspects that the SBM has currently verified and confirmation documents that candidates have actually sent. State health programs need to guarantee that their eligibility guidelines are aligned and that various programs' notices are coordinated in the language they use and their regulations to candidates, specifically for notices notifying individuals that they have actually been denied or terminated in one program however are likely eligible for another. States ought to make sure the SBM call center employees are sufficiently trained in Medicaid and CHIP and should develop "warm hand-offs" so that when callers need to be moved to another call center or company, they are sent straight to someone who can help them. In basic, the state must provide a system that appears seamless across programs, even if it does not fully incorporate its SBM with Medicaid and CHIP. Although minimizing costs is one factor states cite for switching to an SBM, cost savings are not ensured and, in any case, are not a sufficient reason to carry out an SBM transition. It might also constrain the SBM's budget plan in manner ins which limit its ability to successfully serve state locals. Clearly, SBMs forming now can run at a lower expense than those formed prior to 2014. The brand-new SBMs can rent exchange platforms currently developed by personal vendors, which is less costly than building their own innovation infrastructures. These suppliers provide core exchange functions (the technology platform plus customer support features, consisting of the call center) at a lower cost than the quantity of user charges that a state's insurance companies pay to utilize the FFM. States hence see an opportunity to continue gathering the exact same quantity of user fees while using some of those profits for other functions.

As a starting point, it is helpful to look at what a number of longstanding exchanges, including the FFM, invest per enrollee each year, along with what several of the new SBMs prepare to spend. An examination of the budget files for numerous "first-generation" SBMs, along with the FFM, shows that it costs roughly $240 to $360 per market enrollee each year to run these exchanges. (See the Appendix (How to get health insurance).) While comparing various exchanges' costs on an apples-to-apples basis is impossible due to distinctions in the policy choices they have made, the populations they serve, and the functions they carry out, this variety supplies an useful Discover more frame for taking a look at the budgets and policy decisions of the 2nd generation of SBMs. Nevada, which simply transitioned to a full state-based marketplace for the 2020 strategy year, expects to invest about $13 million per year (about $172 per exchange enrollee) once it reaches a consistent state, compared to about $19 million each year if the state continued paying user fees to federal government as an SBM on the federal platform. (See textbox, "Nevada's Shift to an SBM.") State authorities in New Jersey, where insurance companies owed $50 million in user charges to the FFM in 2019, have said they can use the very same total up to serve their citizens better than the FFM has done and plan to shift to an SBM for 2021. State law needs the overall user charges collected for the SBM to be kept in a revolving trust that can be utilized only for start-up expenses, exchange operations, outreach, registration, and "other means of supporting the exchange (How to get renters insurance). How much is gap insurance." In Pennsylvania, which prepares to release a full SBM in 2021, officials have stated it will cost just $30 million a year to operate far less than the $98 million the state's individual-market insurers are expected to pay towards the user cost in 2020. Pennsylvania plans to continue gathering the user cost at the very same level but is proposing to utilize between $42 million and $66 million in 2021 to establish and fund a reinsurance program that will decrease unsubsidized premium expenses starting in 2021. Facts About How Many Americans Don't Have Health Insurance Revealed

It remains to be seen whether the lower spending of the new SBMs will be sufficient to deliver high-quality services to customers or to make significant improvements compared to the FFM (What is unemployment insurance). Compared to the first-generation SBMs, the new SBMs frequently handle a narrower set of IT changes and functions, instead concentrating on basic functions similar to what the FFM has achieved. Nevada's Silver State Exchange is the first "second-generation" exchange to be up and running as a full SBM, having actually simply completed its first open enrollment period in December 2019. The state's experience up until now demonstrates http://riverqyxj287.lucialpiazzale.com/the-8-minute-rule-for-how-much-is-mortgage-insurance that this transition is a substantial undertaking and can provide unanticipated difficulties. The SBM satisfied its timeline and spending plan targets, and the call center worked well, addressing a large volume of calls prior to and throughout the registration period and dealing with 90 percent of concerns in one call. Technical concerns emerged with the eligibility and enrollment process however were identified and solved quickly, she stated. For example, early on, nearly all customers were flagged for what is normally an unusual data-matching issue: when the SBM sent their info electronically to the federal data services center (a system for state and federal agencies to exchange information for administering the ACA), the system discovered they may have other health coverage and asked to submit documents to deal with the matter.

Repairing the coding and cleaning up the data dealt with the problem, and the affected consumers got precise determinations. Another surprise Korbulic mentioned was that a substantial number of people (about 21,000) were discovered ineligible for Medicaid and moved to the exchange. Some were recently using to Medicaid throughout open enrollment; others were previous Medicaid beneficiaries who had been discovered ineligible through Medicaid's regular redetermination procedure. Nevada opted to replicate the FFM's process for handling individuals who seem Medicaid qualified particularly, to send their case to the state Medicaid agency to complete the decision. While this minimized the complexity of the SBM shift, it can be a more fragmented process than having eligibility and registration procedures that are incorporated with Medicaid and other health programs so that people who use at the exchange and are Medicaid eligible can be straight enrolled.

0 Comments

Picking a higher deductible will reduce your cars and truck insurance premium. That's due to the fact that the insurance provider will pay out less if you file a car insurance coverage claim. It also indicates you'll pay more if you require to make a claim that has a deductible. Select a deductible amount you're comfortable with. Think of car insurance coverage as spending for your security from danger. Ariana Gibson, Head of timeshare foreclosure laws a wide array of data about you available to insurance companies, who can utilize it in prices policies. How much is car insurance. This consists of data on customer credit, your prescription drug history, your answers on past private health and life applications, and your automobile record. If you desire life insurance protection that lasts the period of your life, you may think about a universal life insurance coverage policy. For instance, universal life insurance can money a trust to look after a special needs child or other dependents after you're gone. You may also think about a universal life insurance policy if you have big long-term savings objectives and require both a financial investment https://rafaelhvdv876.mozello.com/blog/params/post/3306424/how-much-does-homeowners-insurance-cost-things-to-know-before-you-get-this car and life insurance coverage, but just after you've made the most of other cost savings options such as retirement strategies. See our rankings to find the best life insurance companies. Universal life isn't the ideal option for everybody's scenario. Like universal life insurance coverage, whole life insurance coverage offers you coverage throughout of your life. It also consists of a cash worth part. The biggest distinction between entire life insurance coverage and universal life insurance coverage is the cost: Entire life insurance coverage is usually the most pricey method to buy permanent life insurance coverage since of the warranties within the policy: premiums are guaranteed not to change, the survivor benefit is ensured and money value has a minimum surefire rate of return - How much does health insurance cost. Also, indexed and variable universal life can provide you versatility with payments and the death benefit quantity after you buy the policy.

Entire life insurance coverage is suitable for somebody who likes predictability and wants to spend for it. In addition, lots of entire life insurance coverage policies pay dividends. These are like annual bonus offers paid by mutual insurance companies to consumers, although not ensured. You can utilize dividends to pay premiums, add it to your cash value or merely take the money. Term life insurance coverage is usually readily available for 5, 10, 15, 20, 25 or thirty years. It does not have a cash worth component and you could outlast the policy. But it's the cheapest wesley dale morgan way to buy life insurance coverage. For instance, you might purchase a 20-year policy to cover kids's growing years and college time. About How Much Is Dental Insurance

If you outlive the term life policy it ends. There's no money worth to take away. That's why it's excellent to match your term life policy as best you can to the length of time you'll require protection. Compare Policies With 8 Leading Insurers The essential difference between whole life insurance and universal life insurance coverage is that universal life insurance can have more versatility. You can frequently vary your premium payments and death benefit with universal life. Entire life insurance coverage has set superior payments. However both kinds of policies have cash worth, and you can add riders to either one. But prior to you take the cash value and run, make sure you will not require life insurance coverage in the future. Life's circumstances can change, and you don't want to regret cashing out a policy. If you require money now, consider taking a loan versus the policy instead of cashing it out. That gives you alternatives in the future, including keeping the life insurance coverage in force. Universal life insurance coverage normally ensures a rate as much as a specific age, such as 100 or 105. If you live past that age, you can still keep the policy in force but will have to pay a considerable rate boost. If you need life insurance, it's finest to keep the policy payments up to date. If you have to buy a new policy later on you'l be charged at your older age and might have to take a new life insurance medical examination. Cash worth is really suggested to be utilized during your life. As soon as you pass away, any money value normally reverts back to the life insurance business. Your beneficiaries get the survivor benefit, which is the face worth of the policy minus any unsettled policy loans and withdrawals. That stated, some universal life policies have the option to offer face worth plus cash worth to beneficiaries when you pass away. ">how to get out of a timeshare legally Driver Insights at Clearcover If you have an older vehicle, you might desire to drop coverage like crash and thorough insurance coverage. How does insurance work. Nationally, the average expense of crash insurance coverage is $342 each year and the average expense of extensive insurance coverage is $153, according to the National Association of Insurance Commissioners.

The optimum insurance coverage payout you can get is the value of your cars and truck if it's totaled. For example, if your automobile deserves $2,000 and wfg success rate you have a $1,000 deductible, the maximum insurance coverage claims payment is $1,000. Remember, if you have an automobile loan or lease, the lending institution or renting company normally requires accident and extensive insurance coverage. Even if you're not required to carry these coverage types, it's a good idea to ask yourself if you might manage to pay out-of-pocket to repair your car or purchase a new one if your existing cars and truck is totaled. If you can't, it's probably better to keep these protection types instead of regretting it later. Suspending auto insurance coverage is an action normally booked for circumstances in which you will not be using your automobile at all. An example might be a snowbird who lives in Florida for the winter season and the Northeast in the summertime. Another example is somebody who leaves on military release. In these circumstances, they may desire to suspend crash and liability coverage, given that they would not be driving the car, however keep detailed protection in case of fire, flooding, vandalism or theft. A stay-at-home order is various - What is universal life insurance. Your vehicle is probably with you, indicating you have access to it. You may even decide to drive it to the shop or doctor. If your vehicle insurance business does allow you to suspend coverage, believe two times. If you suspend your crash protection or lower your liability vehicle insurance coverage to just the state-required minimum, you could expose yourself to costly costs like automobile repair work costs or medical expenses if you hurt somebody in a car accident. You ought to only suspend protection in uncommon situations. And accidents can happen even if you're not driving, like a hit-and-run mishap while your cars and truck is parked, falling tree branches and cars and truck theft. Canceling car insurance coverage must be a last resort. If you drive your lorry without insurance coverage, not just could you be accountable for residential or commercial property damage and medical expenses, you could also deal with fines and prison time for driving uninsured. You won't have any protection if something occurs while your car sits in the driveway, like fire, vandalism or theft. And you'll have a "protection gap," which insurance companies view as a greater risk. You'll pay higher rates when you reinstate the policy or purchase from a brand-new business. "Think about car insurance coverage as spending for your defense from threat," Gibson says. She includes that while dropping vehicle insurance coverage can supply short-term gains, it could have long-lasting repercussions. The Only Guide for How Long Do You Have Health Insurance After Leaving A Job?

Owning a vehicle comes with its fair share of costs such as gas, repair work, oil changes, and registration fees. Then there's auto insurance, which can have different costs depending upon your driving record, type of car, and other factors. If you're disappointed with your current automobile insurance rate, here are 8 methods that can help in reducing your costs. Whenever you go to your favorite supermarket, you'll generally get a better offer purchasing several loaves of bread rather than just one - What is health insurance. The same reasoning applies to car insurance. Generally, you'll end up with a higher quote to insure a single lorry rather than guaranteeing numerous cars and/or chauffeurs.

Generally, multiple drivers should reside in the exact same family and be related by blood or marital relationship. If you have a teen chauffeur, you can anticipate your insurance rate to increase considering that teens are a greater liability behind the wheel. However, you might receive a excellent trainee discount rate if your child carries out well at school and has no imperfections on their driving record. Of course, you'll need to reveal evidence to your insurance coverage representative to take advantage of this discount rate. It looks like an apparent idea, but it's one that's worth discussing time and time again. Whether you enter into a fender bender or major automobile wreck, accidents have a direct effect on your cars and truck insurance rate. Make sure you understand the policy's rules for securing money worth and all of the financial implications that feature that decision. You could make a tax-free withdrawal from your policy. However, if you withdraw more money worth than the part funded by your premium payments, the financial investment gains you take are taxed as earnings. Likewise, getting money worth will lower your death advantage and your recipients will get less. Typically you can obtain tax-free from the cash value of your policy. If you die before the loan and interest are repaid, the impressive balance will be subtracted from your survivor benefit. You'll receive the money worth minus any surrender charge. Numerous sellers of universal life insurance coverage use "full underwriting," implying they take time to totally analyze your application, confirm details, and need that you do a life insurance medical examination. The medical examination typically consists of height, weight, high blood pressure, and blood and urine samples. It's typically done by a paramedical expert employed by the insurance provider, and can be done in your home. There's a variety of data about you offered to insurers, who can utilize it in prices policies. What is liability insurance. This consists of data on customer credit, your prescription drug history, your responses on previous individual health and life applications, and your motor car record. If you desire life insurance coverage that lasts the period of your life, you might consider a universal life insurance policy. For instance, universal life insurance can fund a trust to take care of an unique requirements kid or other dependents after you're gone. You might likewise think about a universal life insurance coverage policy if you have huge long-lasting savings objectives and need both a financial investment lorry and life insurance, however just after you've optimized other savings choices such as retirement strategies. See our ratings to discover the finest life insurance companies. Universal life isn't the right option for everyone's situation.

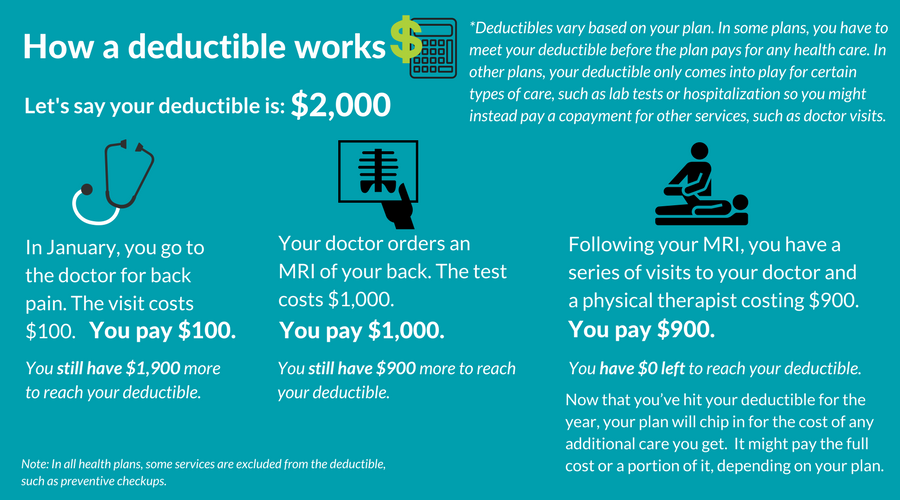

Like universal life insurance coverage, whole life insurance gives you protection for the duration of your life. It likewise includes a money worth element. The biggest distinction in between whole life insurance coverage and universal life insurance coverage is the cost: Whole life insurance coverage is typically the most expensive method to buy irreversible life insurance coverage since of the assurances within the policy: premiums are guaranteed not to change, the survivor benefit is guaranteed and money worth has a minimum surefire rate of return - What is liability insurance. Likewise, indexed and variable universal life can offer you flexibility with payments and the survivor benefit quantity after you buy the policy. Whole life insurance coverage appropriates for somebody who likes predictability and is willing to pay for it. In addition, numerous whole life insurance coverage policies pay dividends. These are like annual bonus offers paid by shared insurance coverage business to consumers, although not guaranteed. You can utilize dividends to pay premiums, include it to your money value or merely take the money. Term life insurance is normally offered for 5, 10, 15, 20, 25 or 30 years. It does not have a money value part and you might outlive the policy. However it's the most affordable way to buy life insurance coverage. For example, you might buy a 20-year policy to cover kids's growing years and college time. The smart Trick of What Is A Health Insurance Deductible That Nobody is Talking About

If you outlive the term life policy it expires. There's no cash value to take away. That's why it's good to match your term life policy as best you can to the length of time you'll need coverage. Compare Policies With 8 Leading Insurers The crucial distinction between entire life insurance and universal life insurance is that universal life insurance coverage can have more versatility. You can typically differ your premium payments and survivor benefit with universal life. Entire life insurance has set superior payments. However both kinds of policies have cash value, and you Go to the website can add riders to either one. But prior to you take Click here to find out more the money value and run, make certain you won't require life insurance in the future. Life's circumstances can alter, and Visit the website you don't desire to regret cashing out a policy. If you require cash now, think about taking a loan against the policy rather than cashing it out. That gives you options in the future, consisting of keeping the life insurance coverage in force. Universal life insurance usually guarantees a rate approximately a specific age, such as 100 or 105. If you live past that age, you can still keep the policy in force but will have to pay a substantial rate increase. If you need life insurance coverage, it's finest to keep the policy payments up to date. If you need to purchase a brand-new policy later you'l be charged at your older age and might need to take a new life insurance medical examination. Money value is really meant to be used throughout your life. Once you pass away, any cash value usually reverts back to the life insurance company. Your beneficiaries get the survivor benefit, which is the stated value of the policy minus any overdue policy loans and withdrawals. That said, some universal life policies have the choice to offer stated value plus cash value to beneficiaries when you pass away. These kinds of protections cover: The damage you do to others, up to your liability limits. Your automobile, up to its fair market value, minusyour deductible, if you are at fault or the other motorist does not have insurance or if it is destroyed by a natural disaster or taken( compensation and timeshare online accident) Your injuries and yours of your travelers, if you are hit by an uninsured driver, as much as the limitations of your uninsured driver policy (uninsured motorist or UM ). Your injuries and those of your guests, if you are at fault, approximately the quantity of your medical protection (PIP or Med, Pay )Complete coverage doesn't cover every scenario you and your car might encounter. Each complete cover insurance coverage will have a list of exemptions, meaning items it will. What is liability insurance. not cover (What is universal life insurance). Racing or other speed contests, Off-road use, Usage in a car-sharing program, Disasters such as war or nuclear contamination, Damage or confiscation by federal government or civil authorities, Using your lorry for livery or delivery purposes; organization use, Deliberate damage, Freezing, Wear and tear, Mechanical breakdown( frequently an optional coverage )Tire damage, Items stolen from the car( those may be covered by your property owners or occupants policy, if you have one )A rental automobile while your own is being repaired( an optional protection) Electronic devices that aren't completely connected, Custom-made parts and equipment (some percentage might be defined in the policy, however you can usually add a rider for greater quantities) You're needed to have liability insurance coverage or some other evidence of monetary duty in every state. com shows the nationwide typical cost per year for comprehensive protection is $192. For crash, it's $526. Likewise, decide now what deductible make good sense for your circumstance. One of the best ways to minimize car insurance coverage is to raise your deductible for accident and detailed insurance coverage, however keep in mind that if you have a claim, that deductible will be your out-of-pocket expense to repair or replace your car. If you have more than one claim, you'll need to pay the deductible each time. We advise you choose an amount that you can pay from cost savings. Your cars and truck will not be fixed till you pay your share.

Be sure to compare the very same vehicle insurance protection by utilizing the same liability limitations, identical deductibles and optional protections. Now that you understand what protections and limits you require, begin now by discovering car insurance provider in your location. Each state requires that you have liability automobile insurance coverage to drive legally. Nevertheless, the quantity state-mandated liability insurance coverage pays out for accidents might not be sufficient to cover the expenditures, leaving you to pay the difference. It also does not cover your own car. For those reasons, Senior Customer Expert Penny Gusner suggests increasing your defense to greater physical injury liability limits and higher property damage liability limits: $100,000 per individual, approximately $300,000 a mishap for medical bills for get rid of my timeshare for free those injured in an accident you trigger, and $100,000 for home damage that you cause. Gusner uses the following professional pointers to reduce the cost of cars and truck insurance without compromising coverage. Be sure to get all discounts for which you certify used to your protection. Trek your deductible. Contrast store at least upon renewal, or after a life occasion, such as marrying, moving, buying a brand-new cars and truck, having a car mishap, but ideally every 6 months. Keep a tidy driving record and inspect your driving record for accuracy, fix any errors. Examine security rankings and purchase an automobile that's considered safe by insurance provider. Buy just liability car insurance coverage if you have an old cars and truck and few assets. Buy your cars and truck insurance coverage and home insurance coverage from the exact same business. Inquire about insurance through a group plan from alumni, expert and organization organizations. Set up safety and anti-theft functions on your automobile. Here we've provided great deals of cars and truck insurance coverage cost price quotes, along with a tool that gives more tailored price quotes, based upon an extensive analysis of various motorist profiles, lorry models and rates for almost all ZIP codes. That means you have an idea of what you'll pay without needing to supply any personal details. However, when getting actual quotes from insurance provider, you'll generally have to provide a minimum of the following: Your license number, Lorry recognition number, Your address, or where the vehicle is kept when not on the roadway, A range of rating factors determine how much you will spend for automobile insurance coverage. In basic the main rating elements are: Kind of cars and truck, Age & years of driving experience, Geographical place, Marital status, Driving record, Annual mileage, Credit rating, Chosen coverage, limits and deductibles, Auto insurance providers track which cars have the most wrecks and the worst injury records. Those aspects affect the expense you pay for liability insurance coverage-- which covers the damage you cause to others (What is comprehensive car insurance). Insurance companies likewise know which automobiles are pricey to buy, expensive to repair or more easily taken. Those aspects drive up the expense of collision and thorough protection, which repair work or replaces your own automobile. The estimations about the danger of a certain vehicle are made independently. I have skipped it often times, and my number has yet to come up. If it turns out that I need to cancel or disrupt, I'll simply have to take my monetary swellings I played the odds and lost. However in some cases it's probably a good idea to get this coverage for example, if you're paying a great deal of up-front money for an arranged tour or short-term lodging leasing (both of which are expensive to cancel), if you or your travel partner have questionable health, or if you have an enjoyed one in your home in bad health. A standard trip-cancellation or disruption insurance policy covers the nonrefundable punitive damages or losses you incur when you cancel a pre-paid tour or flight for an appropriate factor, such as: You, your travel partner, or a member of the family can not travel because of illness, death, or layoff, Your tour company or airline fails or can't perform as guaranteed A member of the family in the house gets ill (check the great print to see how a relative's pre-existing condition may affect coverage) You miss out on a flight or need an emergency flight for a reason outside your control (such as a car mishap, severe weather, or a strike) So, if you or your travel partner mistakenly breaks a leg a couple of days prior to your trip, you can both bail out (if you both have this insurance coverage) without losing all the cash you paid for the journey. This kind of insurance can be utilized whether you're on an organized tour or cruise, or traveling independently (in which case, just the pre-paid expenses such as your flight and any nonrefundable hotel appointments are covered). Keep in mind the difference: Trip cancellation is when you do not go on your journey at all. Trip disruption is when you start a journey however need to cut it brief; in this case, you'll be repaid only for the part of the trip that you didn't total. If you're taking a trip, it may currently feature some cancellation insurance coverage ask - What is health insurance. Some insurance providers will not cover specific airlines or tour operators.

Make certain your carrier is covered. Purchase your insurance coverage within a week of the date you make the very first payment on your journey. Policies bought later than a designated cutoff date generally 7 to 21 days, as figured out by the insurance provider are less most likely to cover tour company or air provider insolvencies, pre-existing medical conditions (yours or those of family members in the house), or terrorist incidents. Mental-health concerns are generally not covered. Tense travelers are complaining about 2 big unknowns: terrorist attacks and natural disasters. Ask your company for information. A terrorist attack or natural catastrophe in your home town might or may not be covered. Even then, if your trip operator provides a substitute travel plan, your coverage may end up being space. As for natural disasters, you're covered just if your destination is uninhabitable (for example, your hotel is flooded or the airport is gone). War or break outs of illness generally aren't covered. With travel turned upside down by the coronavirus pandemic, it's more crucial than ever to understand what travel insurance covers and what it doesn't. While the majority of standard policies provide protection for flight cancellations and journey disturbances due to unanticipated occasions, the majority of COVID-19related concerns are excluded from coverage, including: Fear of travel: If you choose not to travel out of fear of contracting COVID-19, your insurance coverage will not cover you. Getting My How To Get Medical Insurance To Work

Extra COVID-19 outbreaks: If the location you're preparing to visit experiences brand-new shutdowns after you have actually booked the trip, don't aim to your travel insurance coverage for coverage. Going against federal government travel warnings: If you do have coverage, your policy may be voided if you take a trip somewhere that your government has actually considered hazardous, or if your federal government has limited international travel. You may be able to prevent the concern of what is and what isn't covered by purchasing a costly "cancel for any factor" policy (described below). Health emergency situations are the main cause for journey cancellations and disruptions, and they can feature high medical expenses in addition to extended accommodations bills for travel partners. While many US insurance providers cover you overseas, Medicare does not. Likewise, be sure you're mindful of any policy exclusions such as preauthorization requirements. Even if your health plan does cover you worldwide, you may want to think about purchasing a special medical travel policy. Much of the extra coverage readily available is extra (or "secondary"), so it covers whatever expenditures your health insurance doesn't, such as deductibles. However you can likewise purchase primary protection, which will take care of your costs as much as a particular quantity. In emergency situation scenarios involving expensive treatments or over night stays, the health center will generally work directly with your travel-insurance carrier on billing (however not with your routine medical insurance business; you'll likely need to pay up front to the medical facility or center, then get reimbursed by your stateside insurer later). Whatever the scenarios, it's clever to contact your insurance company from the road to let them understand that you've looked for medical aid. Many pre-existing conditions are covered by medical and trip-cancellation protection, depending on when you buy the coverage and how just recently you have actually been treated for the condition. If you take a trip frequently to Europe, multi-trip annual policies can save you cash. Contact your representative or insurance company before you dedicate. The United States State Department occasionally problems warnings about taking a trip to at-risk countries. If you're going to one of these nations, your cancellation and medical insurance coverage will likely not be honored, unless you buy additional protection. Compare the expense of a stand-alone travel medical plan with comprehensive insurance coverage, which includes good medical and evacuation protection. A travel-insurance business can assist you sort out the alternatives. Particular Medigap plans cover some emergency care outside the US; call the company of your extra policy for the details. Theft is particularly uneasy when you think about the dollar worth of the items we load along. Laptops, tablets, video cameras, mobile phones, and e-book readers are all pricey to change. One way to safeguard your investment is to acquire travel insurance from a specialized company such as Travel Guard, which offers a range of alternatives that include protection for theft. The smart Trick of What Does Home Insurance Cover That Nobody is Discussing

It's likewise wise to check with your homeowners or tenants insurance provider. Under many policies, your personal effects is already protected versus theft anywhere in the world but your insurance coverage deductible still uses. If you have a $1,000 deductible and your $700 tablet is stolen, you'll have to pay to replace it. Rather than purchasing different insurance, it may make more sense to add a rider to your existing policy to cover expensive items while you travel. Prior to you leave, it's a good idea to take an inventory of all the high-value products you're bringing. Make a list of serial numbers, makes, and designs of your electronic devices, and take pictures that can function as records. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

June 2022

Categories |

RSS Feed

RSS Feed